This article originally appeared in the 2023 Fall Print Newsletter. Access the PDF here.

Homeownership is one of the most common ways to build wealth in this country, but for Black, Indigenous, People of Color (BIPOC), buying a home is often a challenging experience. To this day, more than five decades after the Fair Housing Act, BIPOC communities continue to face discriminatory policies and racist structures in the financial and housing markets.

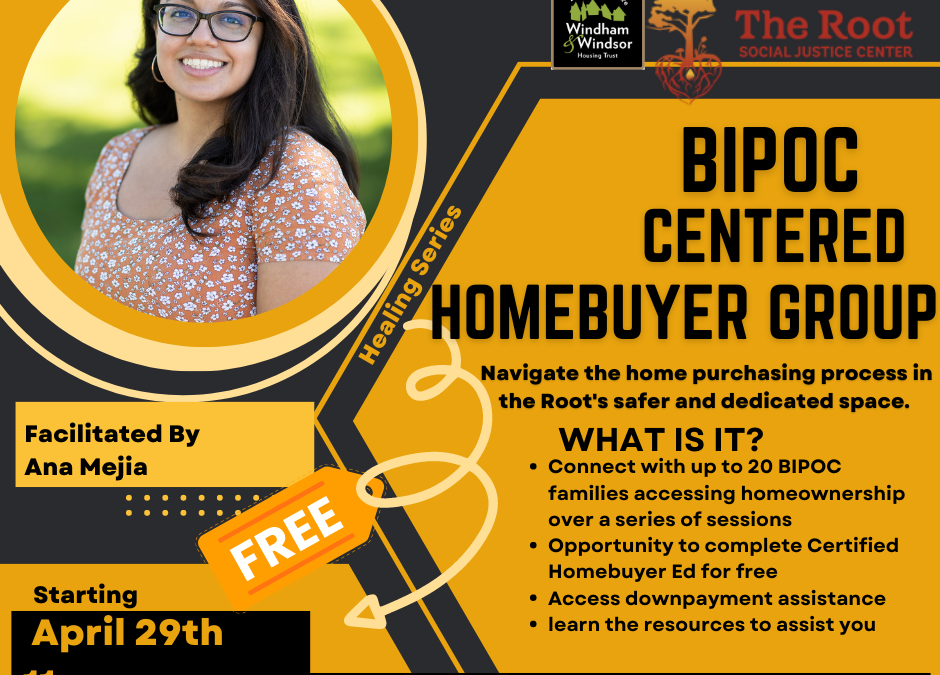

At the Root Social Justice Center in Brattleboro, there is an effort underway to address this disparity and change the experience for BIPOC homebuyers in Vermont. Last spring, in partnership with Windham & Windsor Housing Trust, the Root introduced a BIPOC-centered Homebuyer Affinity Group as part of its broader Healing Series. The overarching goal of the group and its series of workshops, is to assist BIPOC families successfully navigate the path to homeownership, and to provide a safer space to share and learn from each other’s experiences. WWHT secured funding from Key Bank, and provides homebuyer education workshops for free to participants.

Shela Linton is the Executive Director at the Root Social Justice Center, and the person behind the idea. “Affinity groups provide a structure for powerful conversations that build awareness, knowledge, and action for racial equity and justice,” she explains. “At the Root, we are creating spaces that prioritize and meet BIPOC needs. Through this series we’re hoping to dismantle some of the barriers, reclaim our power as BIPOC, and redistribute wealth for ourselves and our families through homeownership.”

Although the initiative is designed specifically for the BIPOC community, participants are welcome to invite their spouse and/or partners regardless of race. “We’re aware that there are biracial families interested in buying homes, and the home financing impacts the entire family,” says Bruce Whitney, Director of Homeownership for WWHT. “We wanted to include those families as well. That’s why we refer to it as BIPOC-centered, rather than strictly BIPOC. It’s a small distinction, but super important.”

Ana Mejia, WWHT Homeownership Specialist, serves as the group’s facilitator, a role for which she was contracted before joining the Housing Trust staff. She draws on her experience as a BIPOC homebuyer to create a meaningful and impactful curriculum. Ana herself encountered racialized experiences during her own, recent homebuying journey. “It was a constant battle. And I always had to have my guard up and advocate for myself. As a person of color, you ask yourself, ‘Is this what other people deal with too? Is this discrimination? Who do I talk to about this?’ That’s what the affinity group is about, where people can ask these questions and share their experiences.”

The inaugural BIPOC-centered Homebuyer Group launched in April, met monthly, and concluded its first full cycle in October. A pre-orientation survey solicited topics of interest, and gauged confidence levels of participants. Over the course of the series, the program saw close to 30 participants in total – some attended only one session – between 6 to 8 attended every one.

“The curriculum was really a work-in-progress,” says Ana. “We wanted to keep it flexible to meet the needs of the participants. I knew that there was an interest in what the steps are – things like what loan options are available – but then there’s also the community building aspect, hearing from other people who are working toward a similar goal. Each session is only 2 hours long, so getting the balance of education versus discussion has been tricky, but I’m feeling really good about what we were able to produce.”

By having participants report on personal goals and accomplishments, Ana says there was also an aspect of accountability. “It’s been really rewarding hearing from people throughout the process, hearing positive feedback from folks, hearing that they enjoy coming to these sessions, and that the information is presented to them in a way that feels accessible. That feels really good.”

Ana used a different word to describe what it feels like to share her own difficult experiences in a group setting. “Cathartic is the only word. Sometimes it’s good to feel like I’m not the only one who’s encountering these things. It’s hard to say good, because we’re talking about such heavy things that we shouldn’t have to experience, but that’s just the reality of it.”

Now that the pilot series has concluded, Ana and Shela are planning for what’s next. A post-program evaluation has been sent to all participants, and that will help inform the next cycle. Ana says the content will expand beyond just homeownership, to include personal finance. And, there is a plan to introduce a Spanish-speaking component as well.

“We’re calling it the BIPOC Financial Empowerment Program. What I’ve noted from this group is there are a lot of people who need more support getting their financial house in order before they’re ready to embark on homeownership and being mortgage-ready.”

And there are even bigger ideas on the horizon.

“We’ve been thinking about a much larger expansion of the program, that is accessible beyond the Brattleboro area to the BIPOC community statewide,” says Ana. “We are in talks with the Rutland Area Branch of NAACP, and other BIPOC organizations about partnering with us, and also with allied organizations – like other Housing Trusts – to build out a referral network.”

Launching the program at a larger scale will require additional funding, so a fundraising effort is underway, with WWHT providing support as fiscal sponsor. “We’ve had such a great experience working with WWHT,” says Ana. “What I have really enjoyed is seeing the organization lean into expertise that Shela and I bring. They are clearly interested in supporting BIPOC homeownership, and they recognize that as non- BIPOC people, they may not have the best understanding of what the barriers are going to be. I have appreciated them taking this humble approach, recognizing where their knowledge gaps are, and leaning into the expertise of the community.”

Ana describes the homebuying process as a master class in understanding how systems of oppression converge. She says it’s important to recognize how these financial systems – the credit system, the banking system, mortgage lending – were not built to support communities of color. “That’s why affinity groups like this are really helpful, in recognizing that we’re swimming upstream – in keeping it real.”

Building connection, educating, and helping more BIPOC people reach their goals of homeownership are all key short term goals of the program. But Ana cites a more transformative, long term goal.

“I’m interested in seeing broader scale, community scale, industry scale changes, so that less people are being set back from their goals. Maybe we’re building referral networks, we’re building trust, we’re building partnerships with financial industry partners, and maybe that leads to changes in their mortgage underwriting criteria. I’m hoping we can move the needle, change the conditions, and shift the biggest obstacles.

“My vision is creating programs that meet critical gaps that exist right now, and through those programs help level the playing field, and create pathways to build wealth in under-served, under-resourced BIPOC communities.”